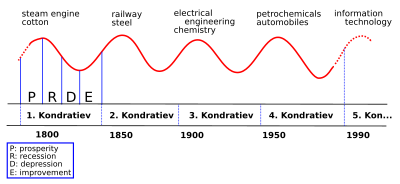

Somehow this thing called "Kondratjeff Wave" is stubborn. I encounter it frequently when the occassionaly business related speaker crosses my path. The idea of Nicolai Kondratjev was that the regular business cycles of boom and bust are overlayed by sixthy year super cycles. The problem with business cycles is that they can not be predicted, we know that there is a boom and then eventualy a bust. We don't know how long a boom stays and when and how long the bust takes. Thats a fact, otherwise the market actors would antecipate each phase change and therefore modify the phases. You see, its unpredictability is native to the markets. Therefore "cycle" might be a term taken with a grain of salt: its periodicity is not constant nor predictable. Now Kontradieff made his proposal of Supercycle 1929 and he figured out three cycles in history. The observation of an invariance of three cycles really means nothing statistically speaking. Take the

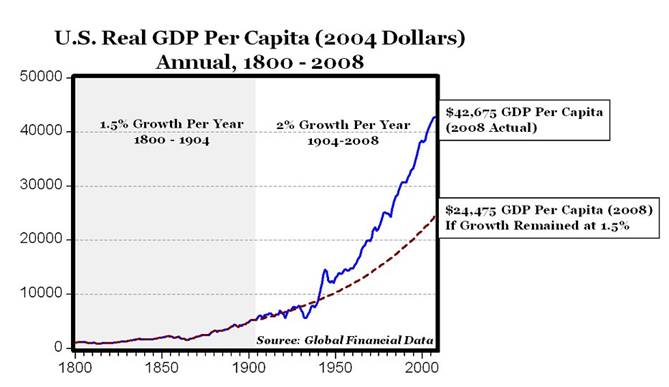

US GDP per capita since 1961, and tell me where the cycles are?

|

The six Kondratieff Cycles

we should have witnessed in the past century

Kondratieff Cycles - hard to spot: remember, they are sixty year periods. It just doesn't fit

|

Ok, If this is convincing, why the Kondratieff spreads like a virus?

- A regular cycle of boom and bust is a persuasive idea.

- We are acquainted with the notion of "epoch" and Kondratieff is a visual representation of the "epoch". Therefore by analogy we understand the concept, it is sound. But conclusions drawn from analogy are not waterproof logical operations. They are merely hints.

- The host of the meme has the opportunity to show technical skills (it looks kind of scientific) and demonstrate deeper insight into long term mechanics of human condition. What an opportunity for the host.

- The witnesses of the meme have the succumb to 1 and 2 and humans are such pattern addicts, they can not resist the temptation to see a regularity.

We need to implant a new meme that represents the truth:

Kontradieff is bogus, they want to fool you with business esoterics.

I have hope for this brand new meme, humans are ashamed of being tricked.

2 comments:

Here in the U.S. at least, the recessions have been getting steadily longer and deeper, according to http://cr4re.com/charts/charts.html?Employment#category=Employment

It seems to me the chart is showing something important, but I haven't done any math to check.

I found your blog because I heard about "improper linear models" and thought they were such a simple idea I wondered whether any previous civilization had discovered and used them. Anyway, interestiong stuff here.

D, currently I work on AHP/ANP which I see as an extention of improper linear models. May be of interest for you. The historical question is interesting too. I would be trilled to see that there is a tradition of model based decision making.

Post a Comment