The fasion of the season is certainly instant update.

http://www.google.com/search?q=tiger&hl=en&gl=us&esrch=RTSearch&rtfu=1260259112&usg=ce37

Tuesday, December 8, 2009

Tuesday, November 24, 2009

Die Suche nach dem Neuen ist eine Folgen von Schritten mit einer Taschenlampe im Dunkeln

Die Schritte sind Experimente.

Wie entsteht das Neue?

Durch eine Kette von Experimenten.

Was ist der Sinn eines Experiments?

Nur die Einsicht: war die Hypothese richtig

Wann ist das Experiment erfolgreich?

Wenn es fehlschlagt und wir verstehen warum.

Wenn es funktioniert und wir verstehen warum.

Wann wurde die Entdeckung vollbracht?

Wenn wir eine Hypothese haben die die Fehlschlägen und Erfolge erklärt.

Wenn diese Hypothese den Ausgang eines neuen Experiments vorhersagen kann.

Wie entsteht das Neue?

Durch eine Kette von Experimenten.

Was ist der Sinn eines Experiments?

Nur die Einsicht: war die Hypothese richtig

Wann ist das Experiment erfolgreich?

Wenn es fehlschlagt und wir verstehen warum.

Wenn es funktioniert und wir verstehen warum.

Wann wurde die Entdeckung vollbracht?

Wenn wir eine Hypothese haben die die Fehlschlägen und Erfolge erklärt.

Wenn diese Hypothese den Ausgang eines neuen Experiments vorhersagen kann.

Monday, November 23, 2009

Wednesday, November 18, 2009

Tuesday, November 17, 2009

Saturday, November 14, 2009

Friday, November 13, 2009

Accelerometer Gestures with a Hidden Markoff Model

How can I train the phone accelerometers to understand my gestures?

http://recg.org/publications/liu08uwave.pdfThursday, November 5, 2009

glaubt jetzt mal ans unterbewusstsein in der tradition der bürgerlichen dämonologie, aka psychoanalyse. am ende des mittelalters gab es ja den grossen nominalismusstreit, ob man aggregierten bezeichnern ueberhaubt trauen darf. die sind sicher ein hilfskonstrukt, eine schlampige heuristik, aber manchmal muss man werkzeuglich damit arbeiten. eigentlich kann man eh nicht anderst, sonst wird jeder gedanke zu einer lebensaufgabe. denke auch das die dahinterliegende werte ungefaehr helfen WENIGER danebenzuliegen als ohne. kann auch schief danebenliegen, und die usanz etwas zu kommunizieren das mittels mehrzahl verwischt werden darf (DIE werte) ist despektierlich: suggestion statt argumentation. aber eigentlich geht es um das psychosomatische. koerperseelenverbindung. Ist das normal? John Sarno sagt ja und kann damit RSI heilen. Lets get some snake oil

Monday, November 2, 2009

Web Innovation

The innovation cycle in the web is bandwidth driven. That's an assumption i share with

Web 3.0 in terms of 'semantic web' faces a information economical problem. With advertisment based monetization being the rule, nobody gives you plain data for free. Where is the incentive? But only if vast ranges of datasilos are released to the web, the semantic vision can come to reality. We may hope for the micropayment revolution to come, which seems around the corner if you look at the effort it is invested in it by startups and mayors.

Meanwhile the coming cycle is happening already, bandwidth driven though: mobile bandwidth.

Thursday, October 29, 2009

Saturday, October 3, 2009

"Im fernsehn zaaagens immer nur des gleiche" sagt mein nachbar. Es ist wohl allgemeinplatz das mit dem produkt TV was net stimmt. Es wird sich was veraendern und diese veraenderung ist auch absehbar: Internet kills the TV Star.

Wie schaut das neue Fernsehn aus? Wer schafft es? Apple? Google? Sony? Disney?

Thursday, September 24, 2009

Future Money

Some vague speculation: See the eCash revolution emerging. When moneytransfer via mobile becomes ubiquitous in a not so far future, everyone with fair webprogramming skills could start a bank. Even issuing your own currency seems easy, remember only the linden dollar.

Already several offline experiments with alternative money have been made, one of them is the postwar Freigeld experiment of Wörgl. But this is oviously the monopoly of the state by now. The central banks own the monopoly, and the state gets veeery angry if you don't comply. In Wörgl the government sent the army to force the city council to give up their currency. Will eCash be illegalized by EU or the European countries? Will there be "black money"?

New currencies ultimately lead also to more instability in economics. Stability would be gained through differentiation of the money but expect new currencies to boom to bust and to fail. The internet is fast and spenders could leave a currency within blinks, devaluating the e-currency in a relentless fraction of time.

Sunday, September 20, 2009

A Wiki Wolfram Alpha

The Encyclopedia of everything computable which W|A is, would gain much momentum if a wiki model could be established for it. There is so much that needs to be calculated in this world, total cost of ownership of a car in Italy anyone?

For this we would need an Excel like interface. Excel is the most widespread tool for calculating stuff. If you want to crowdsource algorithm writing, you need to enable the skilled spreadsheet workforce to use your tool.

We would also need to establish tests to prove the algorithm. Automated regression tests to track erroneous modifications and exploration of the solution space. A qualitative peer review is indispensable, though.

Saturday, September 19, 2009

The Use of Knowledge in Society

Hayeks Article shows how the price system works as proxy for local available information, thus reducing complexity in enterpreneurial decision problems. Interesting footnote: Jim Wales names this paper as fundamental for his organisation of Wikipedia.

As Alfred Whitehead has said in another connection, "It is a profoundly erroneous truism, repeated by all copy-books and by eminent people when they are making speeches, that we should cultivate the habit of thinking what we are doing. The precise opposite is the case. Civilization advances by extending the number of important operations which we can perform without thinking about them.." This is of profound significance in the social field. We make constant use of formulas, symbols, and rules whose meaning we do not understand and through the use of which we avail ourselves of the assistance of knowledge which individually we do not possess. We have developed these practices and institutions by building upon habits and institutions which have proved successful in their own sphere and which have in turn become the foundation of the civilization we have built up.http://web.missouri.edu/~podgurskym/Econ_4970/readings/The%20Use%20of%20Knowledge%20in%20Society.pdf

Wednesday, September 9, 2009

Value at Risk is the perpetrator

My friend Nassim Taleb has been invited as expert witness by the Committee. That's a wise choice. Taleb has not only been a real derivatives trader for decades, but crucially has been warning about VaR's potential for destruction for at least 15 years.

Friday, September 4, 2009

Thursday, September 3, 2009

How to solve it

I need to peek into the Polya algorithm for solving a problem

Tuesday, September 1, 2009

Pensiero Geek des Tages

Da sich die Koerpergroesse von Erwachsenen normalverteilt und sich die Normalverteilung als Summierung unabhaengiger gleicher Zufallsexperimenente beschreiben laesst: ist dann der dahinterliegende Mechanismus eben ein solches Generat? Wenn einem da nur nicht der Zentrale Grenzwertsatz einen Strich durch die Rechnung macht... Kapiert?

Monday, August 31, 2009

Customer Development

Dear Innovators,

Ein neuer Hype pfeift durch die Strassen Silicon Valleys und der Nebel San Franciscos lichtet sich. Einen "Algorithmus zum Startup" soll es geben. Was es ist: eine radikale Standpunktveränderung. Und eigentlich ja logisch. Aus Product Development wird Customer Development, denn wie wir alle wissen: der Kunde zahlt. Nur war uns das nie so ganz klar. Wir träumten ja schon längst von unserem Produkt. Der lästige Kunde wirds dann kaufen. Denn es ist gut. Verdammt gut.

Was ist gut? Fragen wir doch lieber den Kunden, und finden wir den richtigen Kunden und bauen es für ihn, das Produkt.

Thursday, July 30, 2009

The big win of Graffiti was that the Graffiti recognizer was simple - perhaps an order of magnitude simpler than Newton's, maybe more like two. If you invested the small amount of mental effort to learn Graffiti, which was not at all out of proportion to the cost or utility of the Palm, you had a predictable and reliable control mapping with a low error rate, because your brain's internal model of Graffiti was reasonably close to the actual algorithm. Moreover, the process of learning it was actually kind of fun.

Applying this realization to put a good UI on Wolfram Alpha would not be difficult at all. It would not even require removing the giant electronic brain, which could remain as a toy or exploratory feature. Again, it is a perfectly decent toy, and it may even be a reasonable way to explore the space of visualization tools and datasets that WA provides.

Applying this realization to put a good UI on Wolfram Alpha would not be difficult at all. It would not even require removing the giant electronic brain, which could remain as a toy or exploratory feature. Again, it is a perfectly decent toy, and it may even be a reasonable way to explore the space of visualization tools and datasets that WA provides.

Tuesday, July 21, 2009

Wonga

What’s awesome about the Internet is how it breaks up monopolistic markets where middlemen unfairly gobble up outsized fees, leaving us little choice but to keep paying them.

- Techcrunch about Wonga credit serviceThats my vision too. Digital real estate agents anyone? One click Tax-advisor? WWW plumber?

Sunday, July 19, 2009

A new debate

WSJ is jerking around with the Internet.

The way to start a passionate debate today is make a statement no longer than three words, i.e.:Great comment Mr. Ben Atlas

The Future is Free

The Internet is Dead

Friday, July 10, 2009

Tuesday, July 7, 2009

60m east-europeans less

Europe’s 2008 population of 736 million is projectedto decline to 685 million by 2050 becauseof its low country-level TFRs and in spite ofcontinuing net immigration. The decline, however,is expected to take place primarily in easternand southern Europe. Eastern Europe’s 2008population of 295 million is projected to decreaseto 231 million by mid-century, while southernEurope is projected to decrease from 155 millionto 150 million.

Some thoughts on that:

Austrian economy, that highly gained from the new EU member states, will suffer this demographic shift.

Western and Northern Europe are stable, but require higher automatisation of semis-skilled labor.

More semi-skilled immigration from the south - racist parties gain but society is to old for Nazi-cruelties.

US still dominates the century, due its founding myth its open to skilled labor immigration and is highly competitive.

India, Brazil are the new force, if China doesn't make it to become a mature service economy before it grows too old. Russia will decline.

Monday, June 29, 2009

The Law of Small Numbers

In this groundbreaking work Ladislaus von Bortkewitsch shows that rare events are Poisson-distributed.

http://www.archive.org/stream/dasgesetzderklei00bortrich#page/n5/mode/2up

Thursday, June 25, 2009

The Science of Better

Damn, it was Operations Research what we were looking for all the time.

Sunday, June 7, 2009

About the power of innovation

Advocates of innovation describe it as necessary tool in a recession to regain prosperity.

Shed no doubt on it, but this is a macro-economics truth. For a company it does not make sense at all: the innovation bears a risk and we know from the market equilibrium theory that the risk surcharge is such that the utility equals non-risk investments.

A good theory but do I know my risks? Donald Rumsfeld once made an epistemological speech about unknown unknowns. The probability of innovation taking off, in the end is unknown. But theory behave as they would know, they just don't know that they don't know. So in the end its a Rumsfeld-ian "unknown unknown"?

As always, listen to Mr. Taleb carefully. He designates revenue from innovation in the fourth quadrant.

Friday, June 5, 2009

Flippant Juror

During lunch I exercised on the "Flippant Juror Problem"

- a jury of 3 jurors decides by majority

- two jurors are serious experts, they make a right decision with the probability p

- one is a jerk, he just flips a coin with probability for head q=1/2 to decide

Is this jury better than a single person who also makes a right decision with the probability p?

The solution is they are equal. Thats indeed counterintuitive! The jerk sabotages the jury.

Annotation: If they would all flip a coin with majority vote it would be also equal to one flip

This leads to a question related to the electoral process with majority vote in general.

Given N voters, how many "coinflippers" M it takes to reduce their probability for right decision to one decision, hmm try to solve that....

Monday, June 1, 2009

Architecture is about the 'Form follows Function' principle

Functionality should determine the Structure.

If hardware would be perfect, if CPUs would process instantly an infinite amount of input for an extremely complex algorithm. If connectivity would allow for instant access to an infinite amount of data. If our programs could be proven right, never crashed. If nobody could eavesdropping or tamper our system, if one programmer could change the system in every direction at no time... we would not need to think about an architecture. The internal structure of a system would be of no concern.

If hardware would be perfect, if CPUs would process instantly an infinite amount of input for an extremely complex algorithm. If connectivity would allow for instant access to an infinite amount of data. If our programs could be proven right, never crashed. If nobody could eavesdropping or tamper our system, if one programmer could change the system in every direction at no time... we would not need to think about an architecture. The internal structure of a system would be of no concern.

The limits of given technologies demand counter-measures to support functions, therefore we employ architectural patterns and tactics to circumvent undesired limitations.

Not all technology hurdles can be circumvent in this way, and some functionalities remain unimplementable. Thus a quantum computer would allow more functionality but demand new architectures.

In the next post I will outline the Quality Attribute approach, to design the architecture of a software system out of business functions, given technological constraints

In the next post I will outline the Quality Attribute approach, to design the architecture of a software system out of business functions, given technological constraints

Friday, May 22, 2009

Somebody becomes rich just by luck

Whenever one is concerned with rare events, events with small probability of occurrence, the Poisson distribution shows up in a natural way. - Falk, Hülser, Reiss

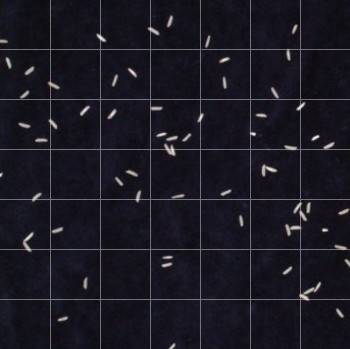

Lets spread some rice corns on a table, each cell represents a person.

Do we expect equal wealth for everyone, given that all have the same virtue and skill?

The Poisson distribution tells us 16 persons get nothing, the probability that you are one of them is 26%.

Over fifty percent get zero or one corn - means they are poor.

Thirtyfour percent are "two or tree corn" people, forming a middle class .

Over fifty percent get zero or one corn - means they are poor.

Thirtyfour percent are "two or tree corn" people, forming a middle class .

A person on the sunny side of life get four and two very lucky ones get even 5 corns, They are the rich five percent of society

| #corn | #people | P(X=corn) | |

| 0 | 16 | 26% | |

| 1 | 14 | 35% | |

| 2 | 10 | 23% | |

| 3 | 6 | 11% | |

| 4 | 1 | 4% | |

| 5 | 2 | 1% | upper-crust |

Random distribution of wealth leads to substancial inequality. Some people just make it, while most struggle. Is this the secret formula of "the american dream"?

Sunday, May 17, 2009

Representativeness Heuristic

Finally I concede myself to start with "Judgment under uncertainty: heuristics and biases" even though not finished with the development part of the Bayesian Network book.

The introductory chapter starts promising: the first cognitive antipattern (bias) discussed

The introductory chapter starts promising: the first cognitive antipattern (bias) discussed

Representativeness

When people are asked to judge if:

A belongs to class B

A originates from B

A follows from B

they use representativeness, or similiarity ommiting factors that should influence our judgement

They compare the description with the stereotype of e.g. a librarian.

Now have a look at the first fallacy with that: we ommit prior probability of outcomes, in fact we should consider that there are many more farmers than librarians before using the stereotype approach.

We fail to take into account prior probability, especially when given worthless evidence, neither wrong nor suggestive but simply worthless. With prior knowledge of a population of two laywers per engineer and the description

Prior probabilities play an important role in Bayesian Networks, thus fixing our biased judgement.

When people are asked to judge if:

A belongs to class B

A originates from B

A follows from B

they use representativeness, or similiarity ommiting factors that should influence our judgement

Steve is very shy and withdrawn, helpful, but with little interest in people. He has a need for order and passion for detail.How do people asess if Steve is engaged in a particular occupation (for example farmer, salesman, librarian, physician)?

They compare the description with the stereotype of e.g. a librarian.

Now have a look at the first fallacy with that: we ommit prior probability of outcomes, in fact we should consider that there are many more farmers than librarians before using the stereotype approach.

We fail to take into account prior probability, especially when given worthless evidence, neither wrong nor suggestive but simply worthless. With prior knowledge of a population of two laywers per engineer and the description

Dick is a 30 years old man. He is married with no children. A man of high ability and high motivation, he promises to be quite succesfull in his field. He is well liked by his colleagues.The experiment shows that overall, the sample judged the chance of Dick being an engineer is fifty fifty!

Prior probabilities play an important role in Bayesian Networks, thus fixing our biased judgement.

Tuesday, May 5, 2009

"Over Christmas, Allen Newell and I created a thinking machine"

A quote honoring Pittsburgh and its "son" Herbert Simon, who also said (in 1971!): What information consumes is rather obvious: it consumes the attention of its recipients. Hence a wealth of information creates a poverty of attention. Actually I desperately need his biography, he seems to be a crucial proponent with the study of human decision-making, behavioral economics and AI.

Best lecture I saw today.

Best lecture I saw today.

Thursday, March 26, 2009

Vacation and Training

I hit the road until mid may, coming back with more architecture related topics.

Sunday, March 15, 2009

Unmasking the Beard

I trained my Bayesian Network modeling skills with a sportsbetting fraud. We call it a beard, when a professional is masking his insider abuse by placing his bets with help of an acquaintance. It will be in nearly all cases a relative or a friend. How can we imply from evidence of surname to being relative? And then from being relative to being "beard?" Or: how can we imply friendship, and then beard?

I trained my Bayesian Network modeling skills with a sportsbetting fraud. We call it a beard, when a professional is masking his insider abuse by placing his bets with help of an acquaintance. It will be in nearly all cases a relative or a friend. How can we imply from evidence of surname to being relative? And then from being relative to being "beard?" Or: how can we imply friendship, and then beard?The naive model presented shows reasonable behaviour.

First the presentation of the marginal probalilities (the numbers) and the inference sensitivity (red boxes) of nodes

Being a beard can only happen if there is a pro to mask. So this evidence remains set. Friends and relatives highly influence the other nodes because of their outgoing edges and their prior conditional probabilities. Interestingly being from same district has also a high impact because its relatively rare measured within a nation. We see, being from the same district increases beard probability +3% in this model:

Being a beard can only happen if there is a pro to mask. So this evidence remains set. Friends and relatives highly influence the other nodes because of their outgoing edges and their prior conditional probabilities. Interestingly being from same district has also a high impact because its relatively rare measured within a nation. We see, being from the same district increases beard probability +3% in this model:

Tuesday, March 10, 2009

Preview of Wolfram Alpha

You can today test a similiar system to the pre announced Wolfram Alpha and get a feeling of the potential. Ask quantitative questions like: How many legs has a chair? How old is Michael Jackson? Now think that WA will actually try to compute stuff: how much bigger is the GDP of US to china? I'm excited!

Monday, March 9, 2009

Regression Towards the Mean

The psychologist Daniel Kahneman referred to regression to the mean in his speech when he won the 2002 Bank of Sweden prize for economics.

| “ | I had the most satisfying Eureka experience of my career while attempting to teach flight instructors that praise is more effective than punishment for promoting skill-learning. When I had finished my enthusiastic speech, one of the most seasoned instructors in the audience raised his hand and made his own short speech, which began by conceding that positive reinforcement might be good for the birds, but went on to deny that it was optimal for flight cadets. He said, "On many occasions I have praised flight cadets for clean execution of some aerobatic maneuver, and in general when they try it again, they do worse. On the other hand, I have often screamed at cadets for bad execution, and in general they do better the next time. So please don't tell us that reinforcement works and punishment does not, because the opposite is the case." This was a joyous moment, in which I understood an important truth about the world: because we tend to reward others when they do well and punish them when they do badly, and because there is regression to the mean, it is part of the human condition that we are statistically punished for rewarding others and rewarded for punishing them. I immediately arranged a demonstration in which each participant tossed two coins at a target behind his back, without any feedback. We measured the distances from the target and could see that those who had done best the first time had mostly deteriorated on their second try, and vice versa. But I knew that this demonstration would not undo the effects of lifelong exposure to a perverse contingency. |

Friday, March 6, 2009

Bailout Micropayment

A thought doesn't leave me. Why does no central bank issue iCash?

A innovation in online payment would lease the liqudity/ loan problem and boost consumer spending. Why not subsidize every computer with a smartcard reader approved for financial transactions?

Don't mix Correlation with Causality

The statistic course or to put it in another way: even if there is a correlation between storks and babys in burgenland, storks are not the cause of their birth.

Saturday, February 21, 2009

Why we should base our decisions on probabilistic networks

We know from behavioral economics that humans are inherently biased in their decisions.

Basically "the expectations we have in our intuitive system are different than in our reasoning system" (D. Kahneman).

Constructing a probability network enables us to use our reasoning system with the qualitative structure of the influences in our decisions, while leaving the actual inference to the conceptual framework of Bayesian statistics. Because this is were usually our intuitive system kicks in and biases us towards wrong decisions. Because we are build to survive in nature, not to reason about the risk of complex derivative finance products.

Having a probabilistic network documents our decisions and allows a Shewart-cycle of improvements.

We would be able to peer review our decision networks and building up a pattern language of optimal decisions. As Steven Wolfram tried for the natural sciences by collecting algorithmic particles describing nature, we could try to make a executable Wiki of fundamental decision patterns describing recurring decision problems.

Basically "the expectations we have in our intuitive system are different than in our reasoning system" (D. Kahneman).

Constructing a probability network enables us to use our reasoning system with the qualitative structure of the influences in our decisions, while leaving the actual inference to the conceptual framework of Bayesian statistics. Because this is were usually our intuitive system kicks in and biases us towards wrong decisions. Because we are build to survive in nature, not to reason about the risk of complex derivative finance products.

Having a probabilistic network documents our decisions and allows a Shewart-cycle of improvements.

We would be able to peer review our decision networks and building up a pattern language of optimal decisions. As Steven Wolfram tried for the natural sciences by collecting algorithmic particles describing nature, we could try to make a executable Wiki of fundamental decision patterns describing recurring decision problems.

Sunday, February 15, 2009

Influence Diagrams

A Bayesian network is a probabilistic network for reasoning under uncertainty, whereas an influence diagram is a probabilistic network for reasoning about decision making under uncertainty. - Kjaerulff, Uffe; Madsen, Anders

An Influence Diagram consists of observations, decisions, utility functions and a precedence ordering. It extends the Bayesian Network by a sequence of decisions in time, their utility and their costs.

For example the Influence Diagram above shows the utility of treating apple trees under the observation that they lose leaf. This can be because of drought or sickness. If the phenomenon persist until later when the harvesting time gets nearer, we might lose income.

For example the Influence Diagram above shows the utility of treating apple trees under the observation that they lose leaf. This can be because of drought or sickness. If the phenomenon persist until later when the harvesting time gets nearer, we might lose income.If we want to maximize income, a cure is barly recommended by the Bayesian inference. It will cost us € 80 and give us a gross income of € 176. We earn € 96 over the € 84 gross for net without treat.

Download a version of the apple tree problem without barren variables leaf' and dry'.

Download GeNie

Saturday, February 7, 2009

Understanding Bayesian Theorem

Eliezer S. Yudkowsky says:

yes = 7.8% genie displays it rounded to 8%

yes = 7.8% genie displays it rounded to 8%

I learned hereby:

Maybe you see the theorem, and you understand the theorem, and you can use the theorem, but you can't understand why your friends and/or research colleagues seem to think it's the secret of the universe. Maybe your friends are all wearing Bayes' Theorem T-shirts, and you're feeling left out. [...] What matters is that Bayes is cool, and if you don't know Bayes, you aren't cool.His first example in a nutshell (by M. H. Herman):

Here's a story problem about a situation that doctors often encounter: 1% of women at age forty who participate in routine screening have breast cancer. 80% of women with breast cancer will get positive mammographies. 9.6% of women without breast cancer will also get positive mammographies. A woman in this age group had a positive mammography in a routine screening. What is the probability that she actually has breast cancer?I modeled this as BN with GeNie and came to the right result:

Only around 15% of doctors get it right (Casscells, Schoenberger, and Grayboys 1978; Eddy 1982; Gigerenzer and Hoffrage 1995; and many other studies.)…On the story problem above, most doctors estimate the probability to be between 70% and 80%, which is wildly incorrect…The correct answer is 7.8%, obtained as follows: Out of 10,000 women, 100 have breast cancer; 80 of those 100 have positive mammographies. From the same 10,000 women, 9,900 will not have breast cancer and of those 9,900 women, 950 will also get positive mammographies. This makes the total number of women with positive mammographies 950+80 or 1,030. Of those 1,030 women with positive mammographies, 80 will have cancer. Expressed as a proportion, this is 80/1,030 or 0.07767 or 7.8%”

yes = 7.8% genie displays it rounded to 8%

yes = 7.8% genie displays it rounded to 8%I learned hereby:

- I don't understand Bayes well yet

- I don't need to understand Bayes to model a Bayesian Network successfully

Friday, January 30, 2009

Advertisment as a game of chance

Let there be no doubt: Ads are a gamble. Their purpose is to increase the chance someone buys your product. I realized this only when i red Seth Godin's thought: "If your ads work throw all the money on them." I think he failed to understand that there can be no determinism between ads and turnover, since an ad is never (1) forcing someone to buy or (2) informing that there is a product fulfilling a desperate need. In both cases: p(ads)=1

What we see is: there is a correlation between ads and turnover. Especially you don't know if the campaign works until you try it, a.k.a. subjective probability. Therefore we should model advertisement as a probabilistic game. Therefore the Kelly Criterion is highly relevant.

Thank you for listening

Thursday, January 29, 2009

Sunday, January 25, 2009

Monty Hall Problem

The Monthy Hall Problem shows how little intuition humans bear to solve probabilistic enigmas.

Tree doors, one hides a price. The candidate chooses one and then the show master opens another one bearing no price. Would the candidate increase his probability in choosing the leftover door, giving up his first choose?

The astonishing answer: the two doors left (the first-chosen and the remaining-closed) are not of the same probability the price-doors. But the remaining-closed now has a probability of 2/3 in comparison with the first-chosen 1/3.

The trick: the show-master opened a door, given the candidates first choice. in 2/3 of the cases he had to avoid the price-hiding door, indicating that the other bears the price. only if the candidates original try was right, the show-master could open any other door.

I modeled this as BN with GeNie:

The candidate chose State0, the quiz-master showed State1 and the price probability resulted in p(Door0)= 1/3 and p(Door3)= 2/3.

Sunday, January 18, 2009

Belief Nets

BNs allow an expert to map his expertise as causal dependencies leading to a certain prediction.

While the domain expert and data available to us build up the nodes and their node probability table (NPT), the reasoning is left to Bayesian Theorem. Machine Prediction with a human designer.

A second benefit is the documentation of the evidences and influences leading to prediction and decisions. The state of the art is in combining Decision Analysis and Belief Nets in the model.

With University of Pittsburgs GeNie modeling tool, the world of Belief Nets opens for experimenting also to the interested layman.

Lets share some experiments!

Saturday, January 10, 2009

Belief

The Bayesian Theorem is one of the most powerful black magic tools of mathematical occultism. I want to formulate in plain text the purpose and properties of Bayesian Theorem.

Given an evidence, to what degree can we assume a hypothesis is true?Lets assume

Evidence e: a bettor places a for him unusual high amount on a horse

Hypothesis h: a bettor has inside information

Problem p(e|h): When we know e, to what degree can we assume h?Hypothesis h is a little hard to prove. We would need a court to judge that there was a inside information or even manipulation of the game. Lets relax h to a more broader term and reformulate the problem. When a bettor places a unusual high amount what is the chance that he wins? We relax h to:

Hypothesis h1: a bettor wins

Where h is part of h1, i.e. a insider needs to win to be an insider.

Where h is part of h1, i.e. a insider needs to win to be an insider.

We could look at what we know about our bettors:

- Certainly we know when a bettor places an unusual high amount, lets say more that 5 times the average in a similar bet. We know how many bettors do that, p(e).

- We know how many bettors are winning in our horse races, p(h1).

- We know how many past times winners betted high, p(e|h1) means literally: given that a person wins what is the likelihood he betted high? We know that from the past.

Now Bayes says we can predict from this data if a person will win if he is staking high.

p(h1|e)= p(e|h1) p(h1)/p(e)

Lets say p(e|h1)>0.5, then we know winners are usually staking high. This gives us evidence that they are confident to win. Why could that be? Reflect on this :-)

p(h1) in a game like horse race should not exceed 0,5 since all the money is in the pot, i.e. there are no more winners than losers and winners are just a few. p(e) will be also under 50%, just because otherwise the amount would be "usual". Whats important here: the smaller p(e) in comparison to p(e|h1) p(h1), the greater p(h1|e).

The chance a highstaker is winning rises when fewer people are betting high amounts, while the ratio of winners that betted high stays the same. That is certainly true.

What is when p(h1|e)>0.5? Then its likely that high stakes lead to big wins.

In the case of p(h1|e)<0.5 I would certainly bet with the bettor without spending a doubt on his reputation.

Sunday, January 4, 2009

The Guy said it all

Forecast from the bottom up. Most entrepreneurs do a top-down forecast: There are 150 million cars in America. It sure seems reasonable that we can get a mere 1 percent of car owners to install our satellite radio systems. That’s 1.5 million systems in the first year. The bottom-up forecast goes like this: We can open up ten installation facilities in the first year. On an average day, each can install ten systems. So our first year sales will be 10 facilities x 10 systems x 240 days = 24,000 satellite radio systems. That’s a long way from the conservative 1.5 million systems in the top-down approach. Guess which number is more likely to happen.

Ads and Kelly

Seth Godin is asking a good question: "do ads work?", and if, why you dont buy all of them.

I want to make a game of it to look at everything through my Kelly Glasses.

What Ads do is improving the edge or advantage you have on a coin where head means buy, and tail means not. The odds are turnover minus costs, lets simplifiy and account only for the marketing costs.

Kelly knows that in a game of chance it's no good idea betting you entire bankroll. You could go bankrupt within one throw. The same is valid for everey amount of investment greater than a certain amount f>f'.

If you could guesstimate your edge right, then G=edge/odds denotes your optimal investment rate

Saturday, January 3, 2009

Guessing the Future of IT

Finaly I found an interesting new years profecy

No more PCs. I think that all Internet communications and work will be done on a handheld wireless device. The device will continue to function as a cell phone, but when you sit down at your desk you will "plug" it into a keyboard and monitor. This wireless device will have 4-8 GB of ram and a sizeable hard drive but all your content and most applications will be stored on the Web.Howard Reingold used to say: "Think of your cellphone as the remote-control of your life"

Subscribe to:

Posts (Atom)